😲 Terra 2.0 is coming

Terra blockchain's revival story, the NFT market's shifting tides, a16z latest crypto fund and more.

Hey👋

Welcome to the mesha tribe: a biweekly newsletter by mesha that brings you all the latest developments in Crypto, NFTs, and Web3 to help you take your net worth #ToTheMoon🚀

📢 We’re inviting 1,000 early access users to team up and buy NFTs with Mesha. Create a team wallet, invite your friends, and split the costs (including gas) across the team.

Benefits:

An original NFT designed by Mesha

100,000,000 $MESHA tokens allocated for early access

Periodic giveaways of blue-chip NFTs to our first 1,000 users

Early access is open to anyone in our community who has reached Level 4, or higher. Get involved in our Discord, share your favourite NFTs, and meet your next teammates!

Sounds good? Sign up below👇

Great! Let’s get started.

Crypto Market Update 📈

The global cryptocurrency market cap stood at the $1.22 trillion mark, falling 3.58% over the last 24 hours. The total crypto market volume rose 5.82% to $78.58 billion during the same period.

Bitcoin (BTC): $29,164.71 (-2.13%)

Ethereum (ETH): $1,839.12 (-6.94%)

Tether (USDT) : $0.99 (-0.01%)

Binance Coin (BNB): $312.40 (-6.40%)

Top Stories 📰

1. Terra 2.0 is almost here

Following the historic meltdown that led to the crypto markets losing $600 billion, the Terra blockchain has a revival plan.

But before that, here's a quick primer to bring you up to speed on the whole situation.

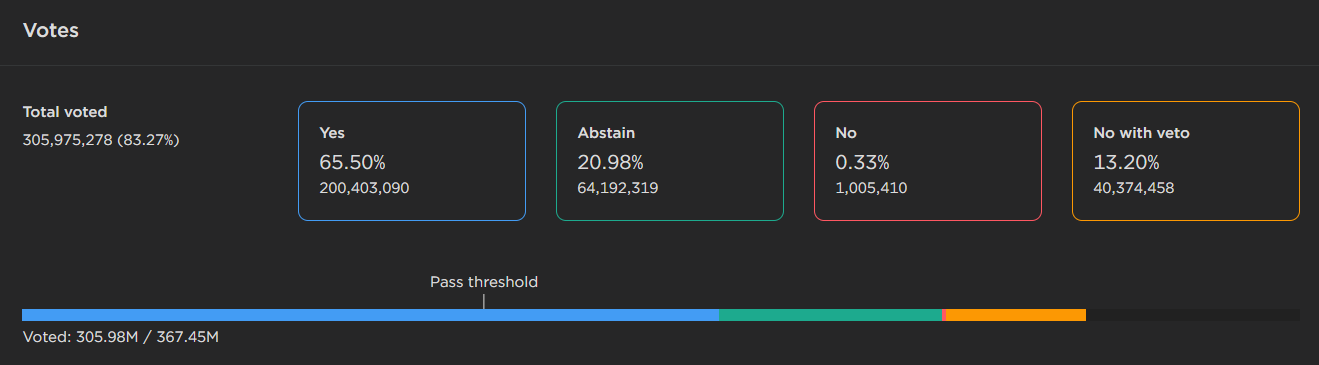

On May 16, Terra ecosystem creator Do Kwon proposed a revival plan called Proposal 1623 that included creating a new blockchain and issuing new LUNA tokens.

Ten days later, it's been approved by the community.

In a series of tweets, Terra outlined how it’s going to implement the plan.

Terra said that it will now create a new chain without TerraUSD (UST), the algorithmic stablecoin.

"The old chain will be called Terra Classic (token: $LUNC), and the new chain will be called Terra (token: $LUNA). The chain upgrade will commence a few hours after the Launch snapshot," it added.

Terra will airdrop 1 billion LUNA tokens to developers, residual UST holders, LUNA Classic stakers, and LUNA Classic holders. The redistribution will include token lockups and vesting schedules to avoid steep price declines.

Here's how it looks:

Community pool: 30%

Pre-attack $LUNA holders: 35%

Pre-attack aUST holders: 10%

Post-attack $LUNA holders: 10%

Post-attack $UST holders: 15%

LUNA was up over 20%, while UST jumped more than 50% on the announcement. To help with the launch, crypto exchanges like Bitfinex, Huobi, and HitBTC announced that Terra’s new chain token Luna will be available on its platform on May 27—its official launch date.

But the skeptics remain unconvinced with Terra’s revival plan.

“This is a very crowded space already with a number of already well entrenched platforms that have lots of developer activity. I don’t see why Terra would succeed here.” said Vijay Ayyar, head of international at Luno.

Here's what the Dogecoin creator had to say about all this:

Why it matters? The UST meltdown has forced industry experts to question the viability of algorithmic stablecoins. And regulators, including SEC Chair Gary Gensler and Treasury Secretary Janet Yellen, have since then called for regulation on crypto—especially stablecoins. Now, even Korean Financial Supervisory Service announced plans to standardize risk assessments of crypto assets.

2. The NFT market is shifting

While the Ethereum network continues to recoil amid the broader crypto market downturn, Solana gains momentum in the NFT space.

According to CryptoSlam data, Solana generated more NFT volume than Ethereum in the 24 hour period on Tuesday. Solana's NFT secondary sales yielded around $24.3 million, while Ethereum generated $24 million.

The increase was due to the launch of Trippin' Ape Tribe, a profile picture collection spanning 10,000 unique avatars launched on Solana NFT marketplace Magic Eden. Following the initial mint, secondary sales for the project reached $14.5 million—surpassing major Solana and Ethereum-based projects, including Bored Ape Yacht Club.

Although this seems like a subtle difference, the data has consistently pointed towards a general trend. Last week, the launch of Okay Bears, another Solana project, had surpassed individual Ethereum projects in the 24-hour trading volume.

Moreover, for almost two weeks, Magic Eden has outperformed OpenSea in transactions and weekly users.

So why is Ethereum falling behind? Two main reasons:

Costs associated with minting NFTs on Ethereum are expensive compared to Solana. ($100 vs $0.015)

The NFT market on Ethereum is rife with scams and fraud.

Recently, a scammer stole 29 Moonbirds worth $1.5 million using a malicious link. Comedian Seth Green also reported that a Bored Ape from his NFT collection, to be used in his upcoming show, was stolen and sold for nearly $200,000.

Why it matters? Solana has been aiming for Ethereum's NFT crown for a while now. And although many creators have migrated to the former, the feared capitulation may not come, considering the upcoming merge, Ethereum 2.0, which will substantially reduce costs associated with minting NFTs.

Deal Street 🤑

a16z raises $4.5B crypto fund

While the crypto markets report record losses, Andreessen Horowitz (a16z) is doubling down on its crypto ambitions. The venture capital giant has announced a $4.5 billion fund dedicated solely to crypto and Web3 projects. The fund, called Crypto Fund 4, is the firm's fourth fund focused on digital assets, bringing its total crypto/Web3 funds raised to more than $7.6 billion. Of the $4.5 billion, the fund will dedicate $1.5 billion towards seed investments, while the rest will be used for venture investments. “We think we are now entering the golden era of web3. Programmable blockchains are sufficiently advanced, and a diverse range of apps have reached tens of millions of users,” a16z partner Chris Dixon wrote in the post. In addition, the company is also expanding its operating teams to help with functions, including research and engineering, security, talent, legal and regulation, and go-to-market.

StarkWare is now worth $8B

Ethereum layer-2 scaling project StarkWare has raised a $100 million Series D funding round led by Greenoaks Capital, Coatue, Tiger Global and others. The latest fundraiser values the company at $8 billion—a four-fold increase since its Series C in November 2021. Founded in 2017, StarkWare has two main products: StarkEx and StarkNet. The former is a scalability engine for crypto exchanges powered by STARK (a cryptographic method to validate transactions), while the latter is a permissionless decentralized zero-knowledge rollup that enables independent deployment of smart contracts. Immutable, dYdX, and Sorare are some projects that use StarkWare's tech. With this latest capital injection, the company aims to work on business development, product, engineering, and growing its surrounding ecosystem.

Tweet Of The Week ✨

Share what you learn 🤝

That’s all for today. If you found this newsletter insightful, subscribe and share it with your friends and colleagues.

Or sign up and discuss the above stories yourself.

See ya next week!👋