🤯 what a wild day

Terra ecosystem flops, Coinbase posts dismal Q1 results, Dapper Labs debuts $725M developer fund and more.

Hey👋

Welcome to the mesha tribe: a biweekly newsletter by mesha that brings you all the latest developments in Crypto, NFTs, and Web3 to help you take your net worth #ToTheMoon🚀

📢 We’re inviting 1,000 early access users to team up and buy NFTs with Mesha. Create a team wallet, invite your friends, and split the costs (including gas) across the team.

Benefits:

An original NFT designed by Mesha

100,000,000 $MESHA tokens allocated for early access

Periodic giveaways of blue-chip NFTs to our first 1,000 users

Early access is open to anyone in our community who has reached Level 4, or higher. Get involved in our Discord, share your favourite NFTs, and meet your next teammates!

Sounds good? Sign up below👇

Great! Let’s get started.

Crypto Market Update 📈

The global cryptocurrency market cap stood at the $1.23 trillion mark, falling 12.82% over the last 24 hours. The total crypto market volume rose 55.47% to $256.38 billion during the same period.

Bitcoin (BTC): $28,922.93.(-9.28%)

Ethereum (ETH): $1,977.36 (-18.28%)

Tether (USDT) : $0.98 (-1.09%)

Binance Coin (BNB): $273.88 (-11.22%)

Top Stories 📰

1. The collapse of Terra

Never have we witnessed the unmaking of an empire happen as suddenly and shockingly as the fate suffered by Terra, a Cosmos-based protocol, whose two primary tokens—TerraUSD(UST) and LUNA—went into freefall yesterday.

UST, its so-called algorithmic stablecoin meant to maintain a 1-to-1 peg with the US dollar, plunged as low as 26 cents, while its sister token, LUNA, meant to act as a shock absorber and maintain the price of Terra's stablecoins, dropped over 99% to less than 10 cents.

To understand how bad things really are, here's some quick perspective:

UST's market cap: $16.06B (yesterday), $6.29B (today)

Luna's market cap: $11.09B (yesterday), $276.5M (today)

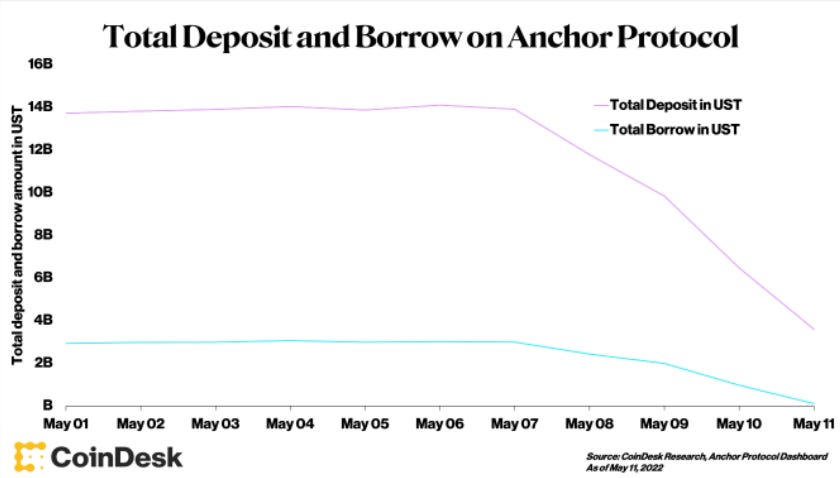

So, WTF happened? Since last week, Anchor, a lending protocol that offers a market-leading 20% yield on UST deposits, saw a sharp decline in deposits. Within days, it went from $14 billion to $6 billion.

Since Anchor is home to over 75% of UST's entire circulating supply, it proved to be a massive problem when UST deposits started declining. Given the limited use case of UST outside Anchor, investors lost confidence and sold their holdings, triggering an enormous sell-off within the Terra ecosystem.

In an effort to shore up UST's price, the Luna Foundation Guard, a Terra-centric non-profit organisation, deployed over $2 billion in its newly-formed bitcoin reserves. But unfortunately, it did little to buoy the stablecoin.

Amid all this chaos, regulators reiterated their concerns surrounding stablecoins. “I think that simply illustrates that this is a rapidly growing product and that there are risks to financial stability,” said Treasury Secretary Janet Yellen during a Senate Banking Committee hearing.

SEC chair Gary Gensler also emphasized the need for regulations on stablecoins, saying that the three largest stablecoins (Binance USD, USD Coin, and Tether) are controlled or have close ties with crypto exchanges.

Why it matters? For years, algorithmic stablecoins have drawn much backlash from the crypto community, with critics calling them "flawed" by design. Unlike reserve-backed stablecoins like Tether, they rely on market incentives and a complex arbitrage system to maintain the price.

2. Coinbase tanks following Q1 results

Coinbase released its first-quarter earnings report, and it did little to brighten the bleak outlook of crypto markets.

The world's third-largest crypto exchange reported a quarterly loss of $430 million, failing to meet the analysts' breakeven expectations. In fact, it underperformed on nearly every key metric.

Here, take a look:

monthly transacting users dropped 20% to 9.2 million, compared to analysts' estimates of 9.9 million.

overall trading volumes fell to $309 billion, from $547 billion in the last quarter.

net revenue stood at $1.17 billion, well below $2.5 billion in Q4 2021.

The news sent its share price to plunge more than 25%, closing at $53.72. Coinbase's market cap presently is around $11.9 billion. (For context, its share price has fallen 80% since its IPO in April last year).

But wait! the saga isn't over yet.

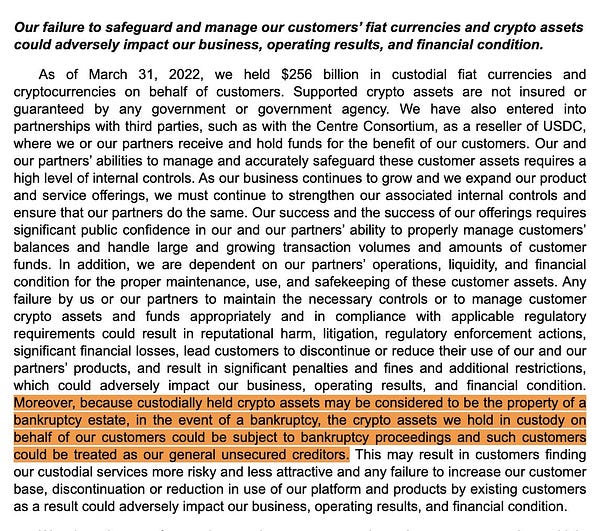

The earnings report also included a new disclosure, which said that Coinbase users could lose access to their holdings if it ever went bankrupt. Naturally, crypto enthusiasts weren't happy about it.

Shortly after, Coinbase co-founder Brian Armstrong reminded users that there weren't any bankruptcy risks and that their funds were safe. But it failed to calm things down.

The company also launched its NFT marketplace this month, but it's off to a slow start so far, reporting fewer than 150 new users on its first day. And apparently, people aren't satisfied with the product.

Why it matters? Despite such dismal Q1 results, Coinbase maintains its long-term optimism as it believes that "the market conditions are not permanent." It's planning to invest in the next generation of crypto opportunities beyond trading.

Deal Street 🤑

Dapper Labs launches a $725M developer fund

Dapper Labs, the creator of NFT-focused blockchain Flow, announced that it secured $725 million in the latest funding round to attract developers to its Web3 ecosystem. The fund is backed by Andreessen Horowitz (a16z), Coatue, Liberty City Ventures, CoinFund, Digital Currency Group, and Union Square Ventures, among others. In September, the company had raised a $250 million funding round at a $2.5 billion valuation. Dapper Labs' Flow blockchain has over 7,000 developers building on the blockchain. With around $1.5 billion in market cap, the protocol has more than 1000 active projects and 175,000 monthly active users. The Web3 platform is best known for powering the blockchain-based trading card platform NBA Top Shot. The funding will be used for "hyper-accelerating gaming, infrastructure, defi, and content and creators” in the Flow ecosystem.

KuCoin now valued at $10B

Global crypto exchange KuCoin has raised $150 million in a pre-Series B funding round led by Jump Crypto. Numerous investment funds such as Circle Ventures, IDG Capital, and Matrix Partners participated in the fundraising, valuing the firm at $10 billion. The company had previously raised a $20 million Series A in November 2018. KuCoin is the fifth-largest crypto exchange, with more than 18 million users in 200 countries. The exchange intends to use the fresh funds to broaden its centralized trading services and expand its Web 3 exposure, including GameFi, crypto wallets, DeFi, NFT platforms, and DAOs. It's currently working on enhancing its security and risk management systems and supporting global regulations requirements.

Tweet Of The Week ✨

Share what you learn 🤝

That’s all for today. If you found this newsletter insightful, subscribe and share it with your friends and colleagues.

Or sign up and discuss the above stories yourself.

See ya next week!👋