FTX Ripple Effects

MakerDAO is changing collateral requirements for DAI, Genesis gets $140M in equity, Tron DAO hoards up on USDT, good reads, updates from mesha and more

Hi there! 👋

Welcome to the mesha tribe: a weekly newsletter by mesha that brings you the latest updates on funding, DAO news and governance to help you take your project #ToTheMoon🚀

In this edition, we discuss:

· The treasury changes of top 5 DAOs

· Latest in web3 deals

· News hot from the web

· Good reads

· Updates from mesha

Subscribe to the mesha tribe for a weekly dose of best industry practices, management tactics, and growth hacks.

Top DAOs By AUM

Deals Deals Everywhere

· Genesis Gets $140M Equity Infusion from Digital Currency Group

Genesis Global Trading has received a $140M equity infusion from parent company Digital Currency Group, a crypto investment firm. It will use the additional capital to bolster its global position and support clients.

· TRM Labs Infused With $70M Series B Funding

Blockchain intelligence firm TRM Labs has received $70M in a Series B extension round led by Thoma Bravo. TRM plans to use the funds for product development and hiring.

· Ramp Network Raises $70M in Series B Funding Round

Ramp Network, a U.K.-based startup offering payment infrastructure to connect crypto and traditional finance, has raised $70M in a Series B funding round that was co-led by Mubadala Capital and Korelya Capital.

· Archax Gets Funding of $28.5M, Led by Abrdn

Digital asset exchange Archax has received $28.5M in a Series A funding round, led by Abrdn, one of U.K.’s largest asset management firms. Abrdn is now one of Archax’s largest external shareholders.

📰Web 3.0 News Updates📰

· MakerDAO Requests Collateral Parameters Change for DAI

In light of how volatile the crypto market has been in the recent past, MakerDAO’s Risk Core Unit has requested changes in the collateral parameters for the DAO’s stablecoin, Dai.

The message proposed that the debt ceiling for MATIC, LINK, YFI and renBTC vaults be reduced by the following amounts:

MATIC: from 20 million to 10 million (50%)

LINK: from 25 million to 5 million (80%)

YFI: from 10 million to 3 million (70%)

renBTC: from 10 million to zero (100%)

If the proposal passes, it will reduce the number of tokens that can be used as collateral to mint new Dai.

Why Does it Matter? Following the FTX news, crypto markets have been extremely volatile. Some of the tokens backing Dai are already dangerously close to the debt ceiling. The unit has mentioned that the proposal is only to curtail temporary setbacks from the current crypto scenario.

· Tron DAO Invests in $1B USDT

Tron DAO, a community-focused body that supports development on the Tron network, is purchasing $1B worth of tether (USDT) stablecoins to safeguard against a market decline.

Initially, the DAO made an announcement that it would be buying $300,00,000 USDT in the market. It followed that up with an update saying it would purchase $1B.

USDT was depegged from its $1 mark due to the FTX news. Tether has been processing payments at the $1 mark despite the depeg.

📚Good Reads📚

· The State of Treasury Management for DAOs

· What is a 51% attack and how to detect it?

· What Makes a Shitcoin 'Shit'? Major Figures in Crypto Disagree

· Investment DAOs: What Are They & How Do They Work?

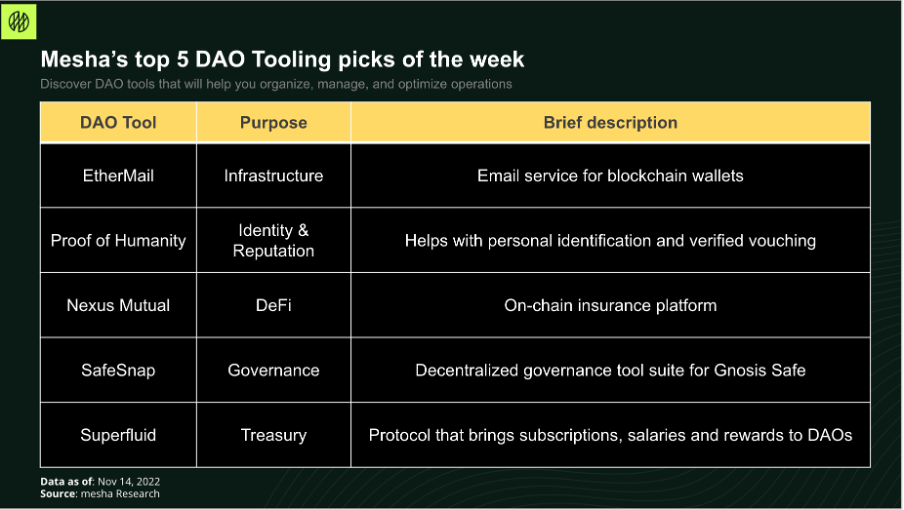

DAO Tools

Updates from mesha

Mesha is live on Solana!! Manage all your finances via a multisig with our integration of Squads protocol

Now send funds using ENS - simply put in the wallet’s ENS and boom, you’re done