📉 what a Meta mess

India's crypto tax is here, Meta reports record stock plunge, Cameo enters the metaverse and more.

Hey 👋

Welcome to the mesha tribe. A biweekly newsletter by mesha that brings you valuable insights from finance, biz, and tech to help you take your net worth #ToTheMoon🚀

Sounds good? Sign up below 👇

Great! let’s get started.

First up,

Market Recap 📈

Indian benchmark indices dropped lower for the second straight day amid volatility. Meanwhile, the US stock market rally sold off as Facebook's owner Meta crashed and dragged other tech stocks.

Sensex: 58,644.82 (-0.24%) ↓

Nifty 50: 17,516.30 (-0.25%) ↓

Dow Jones: 35,111.16 (-1.45%) ↓

Nasdaq 100: 14,501.11 (-4.42%) ↓

Bitcoin: $37,870.20

Top Stories 📰

1. Meta's loss is metaverse's gain

It has been quite a day at Meta Platforms Inc.

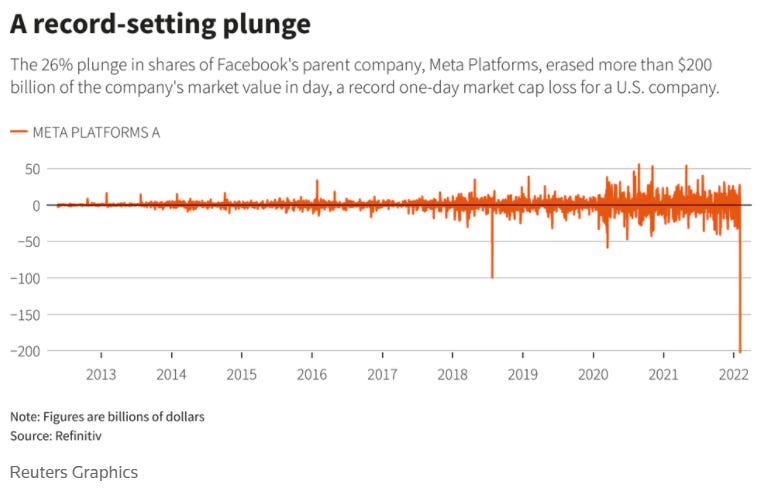

The tech giant, which owns Facebook, reported disappointing Q4 earnings results that sent its shares to plunge 26.4%, erasing a record $251 billion of its market cap in a single day.

Not only was this the biggest drop in market value for a US public company, but it was also the worst one-day loss for Facebook since its debut in 2012. It also wiped off $31 billion from CEO Mark Zuckerberg's net worth—a figure equivalent to Estonia's annual GDP.

Why the drop? Lower-than-expected growth due to inflation, privacy changes to Apple’s iOS, intense competition from rival TikTok and YouTube, and supply chain woes were some of the reasons cited by Zuckerberg during a company-wide virtual meeting, where he told employees to focus on Facebook's short-video product.

But the fall represents a broader trend of tech companies losing market share, and talent, to emerging Web3 startups and projects.

Recently, crypto-backed metaverses like Decentraland and The Sandbox witnessed an uptick in their tokens MANA and SAND, which reported a seven-day gain of 20% and 17.5%, respectively. Plus, more and more gaming and entertainment companies are entering the metaverse every day, making it competitive for tech firms to catch up.

Why it matters? Facebook may have been the first to venture into the metaverse, but it's not leading the movement anymore. And it seems that investors want out ASAP after Zuckerberg commented about the company's "uncertain" future amid intense competition.

2. India wants to tax crypto

India is slowly inching closer to recognizing cryptocurrencies and NFTs.

While hearing that is a relief, the fact that the country's government will now charge a 30% tax on such assets is definitely not.

If that wasn't disincentive enough, Finance Minister Nirmala Sitharaman, who presented the Union Budget on Tuesday, added that -

Losses from their sale of crypto can't be offset against other income.

All virtual digital asset transactions will be taxed 1% at source.

Gift of crypto or NFTs will be taxed in the hands of the recipient.

Sitharaman also said that the RBI will introduce a digital currency (Central Bank Digital Currency) in the next financial year using blockchain and other technologies. In fact, it's already testing it through several controlled trials throughout the country for months to study its consequence on the banking and monetary systems.

Despite regulatory uncertainties, India has shown a great appetite for crypto. WazirX, a Binance-owned crypto exchange, reported $43 billion in annual trading volume last year—a 1,735% growth from 2020.

Today, there are around 15-20 million crypto investors in India, with a total crypto holding of over $5.37 billion.

Why it matters? While proponents of crypto called it a step in the right direction, experts believe that people may end up paying more than 30% in tax and other charges. Also, one important thing to note here is that crypto isn't legalized yet as that can only be determined after a national framework is introduced in the parliament.

Deal Street 🤑

BAYC eyes new investment from a16z

Yuga Labs, a startup behind the popular NFT project Bored Ape Yacht Club (BAYC) that counts celebrities like Snoop Dog, Steph Curry, and Justin Bieber, as owners, is in advance talks of a $200 million funding round that could value the company at around $5 billion. The deal would be the first institutional investment into the US-based NFT creator, which has minted more than 10,000 Bored Apes for nearly $300/piece since April 2021. While that sky-high valuation may seem absurd, the NFT market is booming and is now almost as valuable as the global art market (worth $40 billion). Ownership of the BAYC token allows holders to retain full commercial usage rights and grants them access to exclusive events and limited-edition merchandise.

Cameo enters the NFT space

Personalized video messaging platform Cameo has announced that it's launching Cameo Pass, an exclusive NFT-based community that would allow access to real-life and virtual events, unlock limited release artwork, and provide early access to new Cameo features and projects. The marketplace will also offer limited-edition merchandise and access to a Cameo location in the metaverse. The NFT collection will feature artworks by doodle artist Burnt Toast, NFT artist Vinne Hager, and cartoonist Luke McGarry. Cameo Pass will launch on February 17 on OpenSea and will sell for 0.2 ETH ($559 at present). The company plans to reinvest the proceeds from the NFT sales into exploring "Web3 projects focused on fan/talent interactions.”

Tweet Of The Week ✨

Here’s hoping🤞

Share what you learn 🤝

Found this newsletter insightful? Well, then forward it to your friends and colleagues. Or share it on your social media.

Want to discuss the above stories yourself? Join us.

See ya next week. Bye! 👋