🥶 Surviving The Winter 🥶

Why treasury management rocks, crypto salaries are hot cakes, The Bored Ape Gazette is getting stronger, and more.

Hi there! 👋

Welcome to the mesha tribe: a weekly newsletter by mesha that brings you the latest updates on funding, DAO news and governance to help you take your project #ToTheMoon🚀

In this edition, we discuss:

· Top 5 DAO Treasuries by Assets under management

· The juiciest deals this week

· News updates from DAOs

· mesha is BUIDLing the Bank for Web3

Subscribe to the mesha tribe for a weekly dose of best industry practices, management tactics, and growth hacks.

Top 5 DAOs by $AUM

$$$ In the Bag 💰

· SWEAT Puts $13M In The Pot

Your fitness is going the web3 route. Sweat Economy, the most downloaded Health and Fitness app in the world – has pulled in $13M in funding for its $SWEAT token launch in September. Swiss NEAR Foundation is among the top funders. Polkadot’s Bjorn Wagner, Polygon’s Sandeep Nailwal, Spartan Capital and Electric Capital have added to the pot.

· Barca’s Digital Arm Gets $100M From Socios Owner

Sports is betting big on the metaverse. And Socios owner Chiliz is backing Spanish soccer club FC Barcelona’s dive into web3 and the metaverse. Chiliz is pumping ~$100M to help the club fortify its NFT and metaverse efforts. In turn, Chiliz will own about a quarter of Barça Studios.

· DAO Members to Fund The Bored Ape Gazette

If you’re an avid reader of The Bored Ape Gazette, you’re in for a delight! Apecoin DAO members have agreed to fund the Bored Ape Yacht Club news publication for 12 months to cover “all things ape”. The $150K funding will help the publication’s only writer and editor churn out 3-5 stories a day.

· Space and Time Bags $10M for Upscaling

Analytical insights for your blockchain apps could get cheaper and secure much faster now that decentralized data warehouse Space and Time has $10M worth of funds to expand its engineering team and build the platform. Crypto investment firm Framework Ventures is leading the funding round.

🔥 In The News 📰

1. Treasury Management is 🔑to Weathering Crypto Crashes

If you’re still not reeling from the shock of Terra’s collapse earlier this year, you’ve been living under a rock. However, if you put your skin in the game in web3 projects with strong balance sheets and smart treasury management, YGMI. At least that’s what Kraken Australia’s managing director Jonathon Miller thinks.

While many companies and protocols did take a heavy hit to their treasuries with $LUNA going kaput, protocols with strong fundamentals have largely remained put. Yes, the market value of the total DeFi ecosystem plummeted by 74.6% in Q2 after the collapse of Terra and other DeFi exploits, but the number of daily active users are still more or less the same.

Why does it matter? This shows that the community still has faith. As Miller rightly pointed out, it’s not a blockchain problem. Just as in traditional finance, not having good treasury management can land you in trouble.

2. Millennials and GenZs Want Crypto Salaries

Youngsters want their take-home pay in cryptocurrencies. Looks like crypto is evolving from its use as an alternative asset. For web3 natives, this may not sound like a big deal.

What’s interesting to know is that 36% of the workforce wants to take full or part of their salary in cryptocurrencies. Another 42% want NFTs as performance rewards.

“(Younger generations) know the future lies in tech and appreciate the inherent value of borderless, digital, global, censorship-resistant and nonconfiscatable currencies,” Nigel Green, CEO of the deVere Group, told Cointelegraph. Crypto payments are also becoming a big trend.

The zinger: The regulatory environment for crypto hasn’t been too forthcoming. Despite that, people, especially in high-inflation countries, wanting to be paid in crypto sends a message that these digital assets are just budding. The possibility that their use-case will blossom is a good sign for all web3 protocols and companies building their foundations on digital assets.

3. The End of Decentralization?

DAOs are multiplying like amoeba in the blockchain space. Along with them, the distribution of governance tokens are also increasing. According to DeepDao, there are currently 3.8M governance token holders at the time of writing this newsletter.

Here’s the thing though – governance tokens pose a dilemma – they could incentivize megalomaniacs. How? With their transferability. Ethereum founder Vitalik Buterin tweeted about how transferable governance tokens defeat the whole point of DAOs.

The Debate: While on one hand transferability of governance tokens pose the risk of hostile takeovers, on the other hand, it is illogical to expect everyone in a DAO to participate equally. So delegation is inevitable. Are there ways around it? One Twitter user suggested including poison pills in smart contracts to control the power-hungry. What do you think?

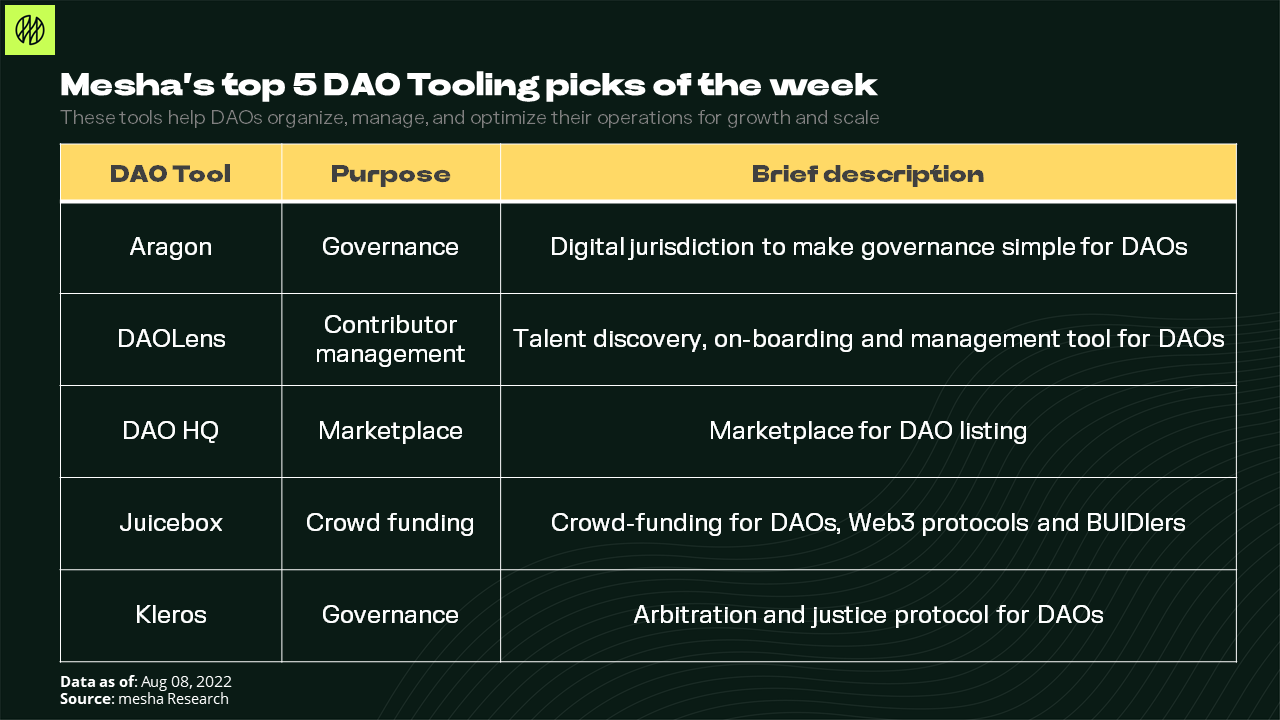

mesha’s DAO Tooling picks of the week

DAOs are playing a pivotal role building the future of decentralized web. In order to scale, DAOs need tools and resources to optimize their operations including areas like community, infrastructure, payments, people and more.

This section brings our top 5 DAO tooling picks for the week 👇

Mesha is building the bank for Web3

Are you a web3 founder, BUIDLer or CFO struggling to manage your organization’s finances?

Mesha offers corporate credit cards, spends management, income/expense tracking, mass-payments, NFT rentals, royalty management, and more to get rid of spreadsheets, and offer a one-stop dashboard for all your organization’s crypto finances.

Our smart money management platform can help your DAO or Web3 organization simplify its finances so that you can focus on building.

Setup for free, it only takes a minute :)

or

Schedule a call now 👇