Hey 👋

Hope you had a great weekend!

Welcome to the mesha tribe—a biweekly newsletter by Mesha, an exclusive social community that lets you chat with friends, discover stocks and participate in challenges all on one platform.

Sounds good? Sign up below 👇

Awesome. Let’s go!

The Big Story

China's property market, a once-flourishing industry that majorly contributed towards the nation’s unprecedented growth for decades, is now trying its best to stay afloat. And it seems that the nation's policymakers have finally heard its distress calls.

On Monday, China's Politburo—the principal policymaking committee of the communist party—moved to expand support for its economy, signalling easing restrictions on its financial and real estate markets.

The meeting, led by President Xi Jinping, announced that it will cut the reserve requirement ratio—the minimum amount of money to be reserved by commercial banks—by 50 basis points, freeing around $188 billion of liquidity.

This move, first indicated by Premier Li Keqiang three days ago, was enough to bump up China's property and financial stocks. CSI Financials Index climbed over 1.3%, while Hong Kong-listed developers and their Shanghai counterparts advanced 2.1% and 2.8%, respectively.

While PBOC reiterated that the cut is an unchanged "prudent" monetary policy stance, UBS economists believe that the nation's senior leadership has finally recognized downward pressures on the economy and are sending "a clear signal of monetary-policy easing."

But it didn’t stop there. It also vowed to maintain a "flexible” monetary policy and fiscal policy next year. Additionally, the central bank also is lowering rates of relending programs for small businesses and the agricultural sector by 0.25 percentage points to further strengthen its economy.

Quite an interesting timing

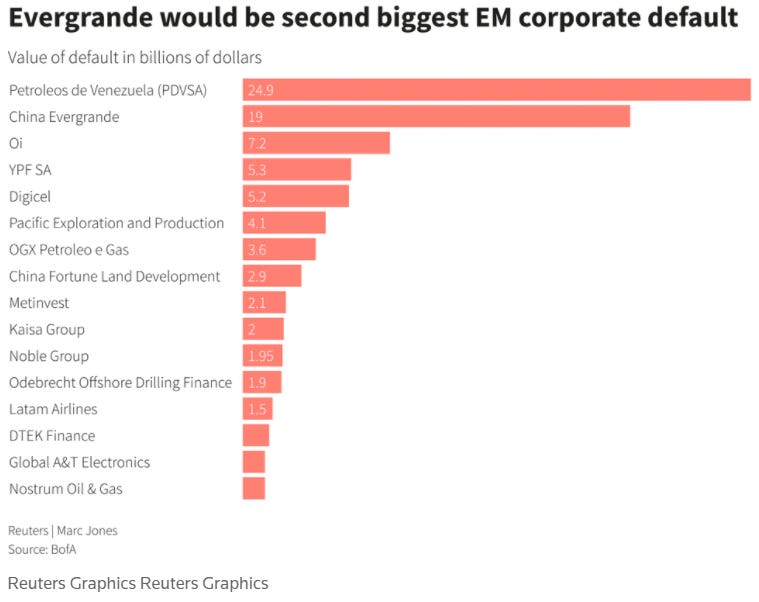

Just last week, Evergrande Group—the world's most indebted developer—said that it can't meet a previously undisclosed $260 million obligation and urged the government to step in as it planned to restructure its offshore debt. The revelation sent its share prices to plummet to a record low of over 20%, signalling a potential beginning of the end.

Then there are the debt repayments totalling $82.5 million that it was supposed to pay yesterday to its US creditors or risk triggering a wave of defaults. Evergrande, which has faced three similar deadlines on offshore bonds since October, has been avoiding them by making payments at the last minute. It has over $343 billion in total liabilities.

Another distressed developer, Kaise Group—China's third-largest issuer of dollar notes among developers—is also obligated to pay $400 million to bondholders today after failing to renegotiate the terms from its investors last week. The developer was the nation's first to default on dollar bonds in 2015.

The big picture

While the recent cuts may provide temporary relief to China's retail developers, the debt crisis is far from being over. According to Goldman Sachs estimate, Chinese property developers face $1.3 billion in US dollar bond payments this month alone, and that number will climb to $17 billion in four months.

For now, it has to fulfil the $157 billion one-year loans maturing on December 15, the same day the cuts will take effect. How will the government make the policy change? How much will it affect the property sector? These are some of the questions looming in investors' minds as they figure out their next move.

Considering the global supply crunch and increasing Omicron variant concerns, China will have to make additional cuts to strengthen its risk assets. How successfully will the world’s second-largest economy implement these policy changes and its subsequent impact throughout the globe is yet to unfold.

Share what you learn 🤝

That's all for today. If you found this newsletter insightful, share it with your friends and colleagues and let us know what you think. Thank you for reading!

We, at Mesha, believe in democratizing finance. Join us and be a part of a community that helps you to take your net worth #ToTheMoon🚀

Until next time, Bye!