🙅 no more hodling

eBay acquires KnownOrigin, BTC miners sell their May reserves, crypto broker FalconX raises Series D and more.

Hey👋

Welcome to the mesha tribe: a biweekly newsletter by mesha that brings you all the latest developments in Crypto, NFTs, and Web3 to help you take your net worth #ToTheMoon🚀

📢 We’re inviting 1,000 early access users to team up and buy NFTs with Mesha. Create a team wallet, invite your friends, and split the costs (including gas) across the team.

Benefits:

An original NFT designed by Mesha

100,000,000 $MESHA tokens allocated for early access

Periodic giveaways of blue-chip NFTs to our first 1,000 users

Early access is open to anyone in our community who has reached Level 4, or higher. Get involved in our Discord, share your favourite NFTs, and meet your next teammates!

Sounds good? Sign up below👇

Great! Let’s get started.

Crypto Market Update 📈

The global cryptocurrency market cap stood at $914.40B, rising 1.50% over the last 24 hours. The total crypto market volume rose 1.89% to $66.32 billion during the same period.

Bitcoin (BTC): $20,668.95 (+0.94%)

Ethereum (ETH): $1,107.88 (+1.18%)

Tether (USDT) : $0.99 (+0.02%)

Binance Coin (BNB): $225.60 (+4.41%)

Top Stories 📰

1. eBay buys NFT marketplace KnownOrigin

Gone are the days when OpenSea was described as being the “eBay of NFTs.” Because now, we actually have one.

E-commerce giant eBay has announced that it has acquired the NFT marketplace KnownOrigin. While the terms of the deal remain unknown, eBay said that the purchase is a crucial step in its "tech-led reimagination."

"eBay is the first stop for people across the globe who are searching for that perfect, hard-to-find, or unique addition to their collection and, with this acquisition, we will remain a leading site as our community is increasingly adding digital collectibles," said eBay CEO Jamie Iannone.

Back in May last year, eBay first made its first foray into the space when it allowed the sale of NFTs on its platform just as the sector exploded into mainstream popularity. More recently, the platform released its debut NFT collection, consisting of 13 limited-edition digital collectibles featuring 3D-animated renders of hockey legend Wayne Gretzky.

More on KnownOrigin: It's a Manchester-based NFT marketplace that runs on Ethereum and allows users to buy, sell, and mint digital art. Since its inception in 2018, the platform has generated $7.8 million in sales. In February, it also raised a $4.3 million Series A funding round co-led by Genesis Block Ventures and Sanctor Capital.

The announcement comes amid a flurry of acquisitions, launches, funding and notable hires in the NFT space:

Uniswap bought NFT marketplace aggregator Genie.

Crypto hardware firm Ledger launched an NFT marketplace and Web3 service platform for enterprises.

NFT project Doodles raised debut funding from Reddit co-founder Alexis Ohanian and announced musician Pharrell Williams as its chief brand officer.

Why it matters? While the broader crypto market collapse caused a ripple effect throughout the various industries, the NFT community seem to be partying harder than ever. What’s more, the NFT volume for the month has risen slightly, from $62.2 billion at the beginning of June to $63.4 billion.

2. BTC miners are no longer hodling

The crypto winter has sent chills down the entire crypto market and even the og HODL crowd isn't immune to it.

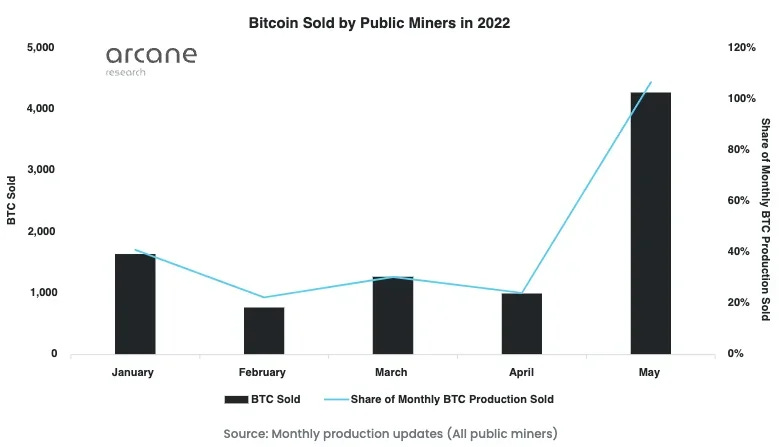

According to a new report by Arcane Research, public Bitcoin mining companies sold 100% of their BTC production last month, compared to the usual 20-40% earlier.

Yesterday, Toronto-based Bitfarms sold 3,000 Bitcoin for $62 million to pay off debt. Last month, Riot Blockchain traded 250 Bitcoins for $10 million—nearly half of its April BTC production. Other major publicly-traded Bitcoin miners like Core Scientific and Argo Blockchain have also sold 2,598 and 427 coins respectively.

Why, you ask? Well, because it's unprofitable.

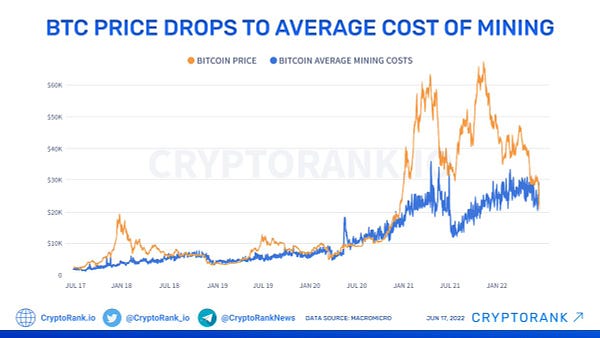

Rising hash rate and pessimistic market conditions have pushed down profit margins for miners, who are now required to deploy more computational power to gain similar outputs as they previously did. And that’s despite having access to cheap electricity and energy-efficient machines. In fact, the price of BTC is now on par (or even lower for some miners) with the average mining costs.

But the sell-off isn't recent; it has been happening since the beginning of the year. And as Bitcoin battles to trade above $20,000, the substantial BTC dumping is only expected to increase.

Of the 800,000 Bitcoin that miners collectively hold, public miners own only 46,000. While they only account for 20% of the total network hash rate, their behaviour reflects the sentiments of private miners too.

Why it matters? While profit recovery depends on several factors, regulation proves to be a major obstacle as legislators continue to voice sustainability concerns over the energy-intensive proof-of-work consensus model. Just last week, several US lawmakers sent a letter to the Environmental Protection Agency, seeking their input on the impact of crypto mining.

Deal Street 🤑

FalconX raises Series D

Investment firms continue to remain bullish on crypto despite the recent market rout. Yesterday, crypto broker FalconX announced that it raised a $150 million Series D funding round at an $8 billion valuation. Led by GIC and B Capital, the round saw participation from other investors, including Wellington Management, Tiger Global, Thoma Bravo, and Adams Street Partners. Previously, the Chicago-based trading desk had raised $210 million in a Series C funding round. In April, FalconX became the first crypto-focused swap dealer registered with the Commodity Futures Trading Commission and a member of the National Futures Association. The fresh funding will help the company develop new products, make acquisitions, upgrade its tech and data analytics, enable new markets for institutional customers, and increase its workforce by 30%.

Magic Eden reaches unicorn status

NFT sales may be flatlining, but the funding flowing into the space sure isn't. Leading Solana NFT marketplace Magic Eden has now raised $130 million in a Series B funding round as it plans to expand beyond the ecosystem. The latest fundraising values the company, founded in September last year, at $1.6 billion. Electric Capital and Greylock co-led the round, with Lightspeed Venture Partners joining the round alongside existing investors such as Paradigm and Sequoia Capital. Magic Eden handles over 90% of Solana's gaming NFT volume and has 50+ games and metaverse projects. Recently, it surpassed OpenSea—another leading NFT marketplace on Ethereum—in daily transactions and volume. With this fresh funding, the company plans to expand primary and secondary marketplaces, hire new staff, upgrade existing tech, and explore multi-chain opportunities.

Tweet Of The Week ✨

Share what you learn 🤝

That’s all for today. If you found this newsletter insightful, subscribe and share it with your friends and colleagues.

Or sign up and discuss the above stories yourself.

See ya next week!👋

Heyy! Such an insightful dose, thanks!

P.S. Would you be interested in discussing some collaboration or partnership opportunities? How can we reach out?