Hey 👋

Hope you’re having a great week!

Welcome to the mesha tribe—a biweekly newsletter by Mesha, an exclusive social community that lets you chat with friends, discover stocks and participate in challenges all on one platform.

Sounds good? Sign up below 👇

Awesome. Let’s go!

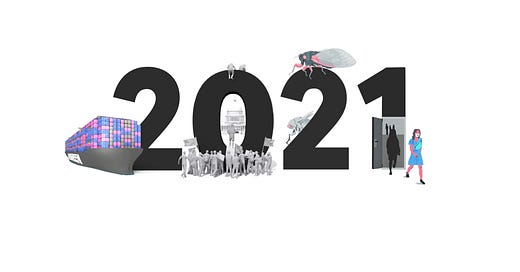

2021: A Year In Review

Believe it or not but 2021 is ending.

And it has been a wild year, from billionaires losing their billion-dollar status in less than two days to Suez Canal obstruction that limited gift choices for birthdays and Christmas presents.

While it was a bleak year for the masses, tech, finance, and crypto saw one of their most profitable years to date. This edition will focus on the mega deals, fundings, IPOs, and all the other trends we saw this year.

First up,

I. Tech

2021 was the year of tech. But the biggest development was in medicines, not machines, which saved millions of lives worldwide. We have administered more than 9.09 billion doses of COVID-19 vaccines across 184 countries—the biggest vaccination campaign in history.

For India's startup ecosystem, it was undoubtedly the best year yet. We saw 42 startups achieve the coveted unicorn status, including Mensa Brands, which became India's youngest unicorn after reaching a billion-dollar valuation in just six months. They raised over $5.3 billion across 31 funding transactions, with more than 140 investors participating in various round-types this year. India also surpassed the UK to become the third-biggest unicorn hub after the US and China.

2021 was also a big year for M&A transactions in tech, with software giant Oracle buying healthcare IT service company Cerner for $28.3 billion, Salesforce purchasing Slack for $27.7 billion, and Microsoft's $19.7 billion acquisition of AI and speech recognition platform Nuance.

But we'd be remiss if we didn't mention the fall of everyone's beloved social giant Facebook, whose disastrous outage in October caused the platform to collapse for six hours, making it the largest communications breakdown in history. Plus, a whistleblower complaint about Facebook promoting false information and inciting violence, among several other allegations, supposedly nudged the company to change its name to Meta—highlighting its big move into VR services.

II. Finance

Last year completely revolutionised finance, as meme stocks to popularity after Reddit’s WallStreetBets decided to give a royal FU by bidding up GameStop and AMC Entertainment—stocks that were heavily shorted by hedge funds. And as more and more retail traders joined the movement, many startups IPO'ed via SPACs (special purpose acquisition companies). In 2021, over 600 SPACs went public and raised more than $160 billion in capital.

Massive liquidity in the market hugely benefitted the Indian IPO ecosystem, which raised $453.3 billion from 2,388 deals this year. The companies that went public include some of the biggest names such as Zomato, Nykaa, Policybazaar, CarTrade, MapMyIndia, and Paytm, among others. Not just that, India's fintech and e-commerce firms also had a remarkable year as insurtech firms like Acro and e-commerce platforms like Meesho surpassed the $1 billion mark. Plus, India created 4 healthtech unicorns and 10 SaaS unicorns this year.

III. Crypto

For overly enthused traders, the stock market wasn't enough this year. So they moved to the next best thing: cryptocurrencies. As investors heavily started investing in Bitcoin and other altcoins such as Ethereum, Litecoin, Monero, and others, they were joined by big firms like Tesla, PayPal and Microstrategy, with even the governments taking a keen interest. The global crypto market now stands at $2.22 trillion.

Cryptocurrencies also witnessed the so-called 'meme effect' promoted heavily by Tesla CEO Elon Musk during his SNL appearance in May. Soon, Dogecoin, Shiba Inu, and other meme coins garnered massive mainstream attention, and lo and behold, we now have more than 250 meme tokens.

But the most fascinating development took place in an investment vehicle based on the same underlying technology as Bitcoin: Non-fungible Token (NFT). While it was conceived in 2014, NFTs became known to the masses in the first six months of this year after digital artist Beeple sold his NFT, Everydays: The First 5000 Days, for $69 million in March. Soon the idea transformed into art, music, and sports, enabling monetisation of digital assets. As of December, the global NFT trade reached $23 billion.

And we're only getting started. As we see more fantastic development in Web3 technologies, it's only a matter of time when even these will seem normal.

Until next time 👋

Oh and before we go,

Share what you learn 🤝

Yay, you made it!

If you found this newsletter insightful, share it with your friends and colleagues and let us know what you think. Thank you for reading.

We, at Mesha, believe in democratizing finance. Join us and be a part of a community that helps you to take your net worth #ToTheMoon🚀