☯️ layoffs and hires

Crypto exchanges are firing and hiring people, Bill Gates slams NFTs and crypto, NFTPort raises Series A and more.

Hey👋

Welcome to the mesha tribe: a biweekly newsletter by mesha that brings you all the latest developments in Crypto, NFTs, and Web3 to help you take your net worth #ToTheMoon🚀

📢 We’re inviting 1,000 early access users to team up and buy NFTs with Mesha. Create a team wallet, invite your friends, and split the costs (including gas) across the team.

Benefits:

An original NFT designed by Mesha

100,000,000 $MESHA tokens allocated for early access

Periodic giveaways of blue-chip NFTs to our first 1,000 users

Early access is open to anyone in our community who has reached Level 4, or higher. Get involved in our Discord, share your favourite NFTs, and meet your next teammates!

Sounds good? Sign up below👇

Great! Let’s get started.

Crypto Market Update 📈

The global cryptocurrency market cap stood at $907.19B, rising 0.60% over the last 24 hours. The total crypto market volume rose 0.54% to $105.54 billion during the same period.

Bitcoin (BTC): $21,115.90 (-0.11%)

Ethereum (ETH): $1,111.65 (+0.12%)

Tether (USDT) : $0.99 (+0.06%)

Binance Coin (BNB): $215.91 (+2.19%)

Top Stories 📰

1. Crypto’s wave of layoffs has begun

Crypto exchanges are firing people left and right as the industry deals with the recent crypto crash, interest rate hikes, and skyrocketing inflation.

Coinbase, the first crypto exchange to become a Fortune 500 company, is laying off 1,100 employees—18% of its total workforce.

BlockFi CEO Zac Prince said the company is firing 20% of its 850 employees.

Crypto.com, which bought the naming rights for Staples Center stadium last year, announced it's laying off 260 people.

Crypto platform Gemini is letting go of 10% of its workforce.

But why tho? To cope with the harsh crypto winter.

This week alone, Bitcoin lost almost a quarter of its value, while Ethereum sunk more than 35%. This was mainly due to the combination of shocks induced by the Terra ecosystem collapse, Celsius halting user withdrawals, and the endless discussions surrounding regulatory scrutiny over the digital asset market.

The situation is reminiscent of the 2018 crypto bear market when firms like ConsenSys and Status.IM laid off 60% and 25% of its staff. Only difference? That bear market was milder.

“If you compare this to previous bear markets, this happened very fast,” web3 educator Tascha Che told Time.

But it all ain't that bleak: In hopes of countering such layoffs, firms like Binance, Kraken, FTX, and Polygon have accelerated their hiring efforts.

Binance hopes to hire 2000 people across Europe, Asia, South America, Africa and the Middle East.

Kraken announced that it's planning to hire more than 500 staff.

Polygon Studios CEO Ryan Wyatt tweeted that the company plans to increase its headcount by 15% this year.

Last week, FTX CEO Sam Bankman-Fried also tweeted about his plans to keep pushing their hiring efforts.

Why it matters? Since its inception, crypto has dealt with several boom and bust cycles. But given the ripple effects of the recent crypto crash, some experts think that a rebound could take years.

2. NFTs and crypto are a sham

…or at least that's what American billionaire Bill Gates thinks about them.

While speaking at the TechCrunch Climate Change conference, Gates talked at length about the climate movement, shared his assessment of today's global economy, and expressed his deep skepticism of the digital asset industry.

“As an asset class, it’s 100% based on the greater fool theory—that somebody’s going to pay more for it than I do,” he said.

Well, what’s that? Basically, it’s a notion that suggests that overvalued assets will keep going up because there are enough people willing to pay high prices for them.

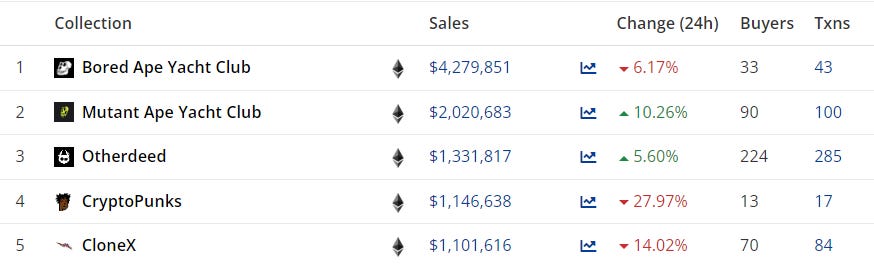

The Microsoft co-founder also sarcastically commented about Bored Ape Yacht Club, the most popular NFT collection in the space, saying that they're "obviously" going to improve the world.

Gates' comments come at a time when NFTs and the broader crypto market experiences a sharp decline in prices amid Federal Reserve's record interest rate hikes, rising inflation, record layoffs, and two high-profile incidents that sparked panic sell-off within the industry.

Combine this with the rampant fraud and scams and you get to some of the darkest days in the history of the crypto bear markets, including the NFT space, wherein monthly trading volumes have dropped by 56% to $500 million.

Why it matters? Although Gates has consistently cautioned investors against crypto and other digital assets, Microsoft has launched several NFTs-based initiatives under his leadership. This includes Azure Heroes (an Ethereum-based digital collectible to promote and reward inclusive behaviours among developers) and Azure Space History (a game celebrating women in science that rewards players with Minecraft-compatible NFTs).

Deal Street 🤑

NFTPort raises a $26M Series A

While the digital asset market continues to plunge, an Estonian NFT startup has fetched $26 million in a Series A funding round. Co-led by Taavet+Sten and Atomico, the round saw participation from Protocol Labs, Sparkle Ventures, Polkadot co-founder Jutta Steiner, Polygon co-founder Jaynti Kanani, former Coinbase CTO Balaji Srinivasan, and others. NFTPort, which was founded in 2019, provides an NFT infrastructure that enables companies to launch their apps to markets within hours. It also includes APIs for data, minting and counterfeit detection. The fresh funding will be used to expand to new blockchains, hiring efforts, and scaling its core product offering. The startup is also preparing to bring a decentralized NFT infrastructure protocol to market. (Check out their 20-slide pitch deck they used to get the funding.)

Blockchain VC firm TGV doubles down on web3

Singapore-based venture capital firm True Global Ventures (TGV) has secured the first close of its $146 million follow-on fund. The announcement comes a year after the company closed its True Global Ventures 4 Plus base fund—a $100 million fund focused on later-stage web3 companies, operating across three business verticals: entertainment & gaming, financial services, and artificial intelligence. The new fund, called the TGV4 Plus Follow On Fund, has received a general partner (GP) commitment of over $62 million from a group of 15 GPs. The follow-on fund will focus on selected TGV 4 Plus base fund companies, including Forge, Animoca Brands, Chromaway, The Sandbox, GCEX, Coinhouse, and others. Launched in 2019, TGV consists of an international group of serial investors. It has a global presence in 20 cities, including Dubai, Hong Kong, Moscow, Madrid, and San Francisco.

Tweet Of The Week ✨

Share what you learn 🤝

That’s all for today. If you found this newsletter insightful, subscribe and share it with your friends and colleagues.

Or sign up and discuss the above stories yourself.

See ya next week!👋