🔥 burn baby burn

Yuga Labs' Otherside metaverse land sale raises $320M, crashes the Ethereum network.

Hey👋

Welcome to the mesha tribe: a biweekly newsletter by mesha that brings you all the latest developments in Crypto, NFTs, and Web3 to help you take your net worth #ToTheMoon🚀

📢 We’re inviting 1,000 early access users to team up and buy NFTs with Mesha. Create a team wallet, invite your friends, and split the costs (including gas) across the team.

Benefits:

An original NFT designed by Mesha

100,000,000 $MESHA tokens allocated for early access

Periodic giveaways of blue-chip NFTs to our first 1,000 users

Early access is open to anyone in our community who has reached Level 4, or higher. Get involved in our Discord, share your favourite NFTs, and meet your next teammates!

Sounds good? Sign up below👇

🎙️Spill the NFT: We host a weekly Twitter Space where we invite industry experts to discuss their experiences and latest developments in NFTs and Web3 every Thursday at 8 PM IST. Check out our Twitter for the guest list 👀

Great! Let’s get to it.

The Big Story

This past weekend, Yuga Labs, the entity behind the popular Bored Ape Yacht Club (BAYC), launched the sale of virtual land related to the much-awaited metaverse project Otherside.

Traders bought from the limited supply of 55,000 virtual land Ethereum-based NFTs, known as Otherdeeds, which were sold for around $7,000 each via BAYC's native ApeCoin (APE).

It was the largest NFT mint in history, generating $320 million in revenues for Yuga Labs. In a way, the sale functioned like an unofficial funding round for Yuga Labs, which previously raised $450 million in a round led by Andreessen Horowitz (a16z).

But, boy oh boy, was it expensive AF.

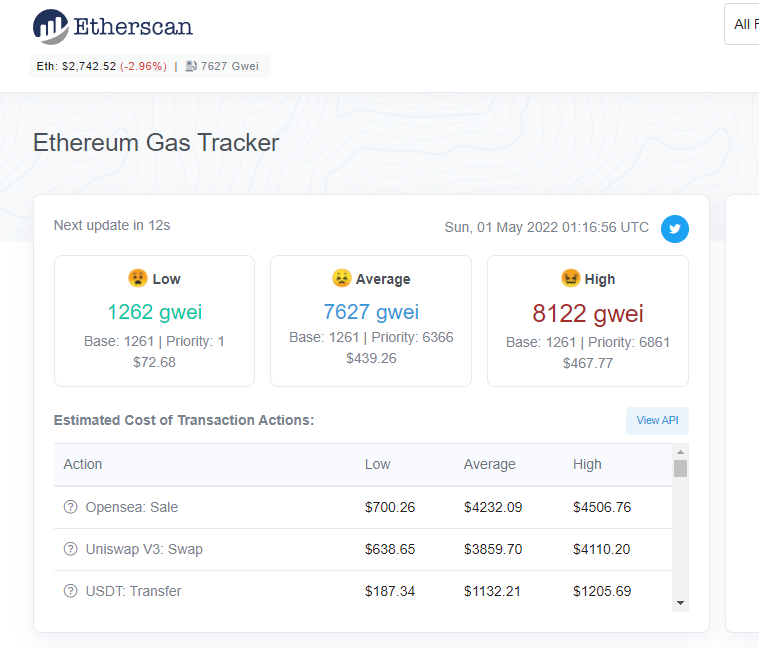

To snap up one of these virtual plots, investors spent more than $176 million on gas fees just within 24 hours of launch. Demand for Otherdeeds was so high that users ended up paying somewhere between 2.6 ETH ($6500) to 5 ETH ($14000) in gas fees for each NFT.

Although the Otherdeeds were minted in APE, they still required Ethereum for gas fees.

A brief primer on gas fees: They’re costs associated with transactions that increase when the Ethereum blockchain gets more congested.

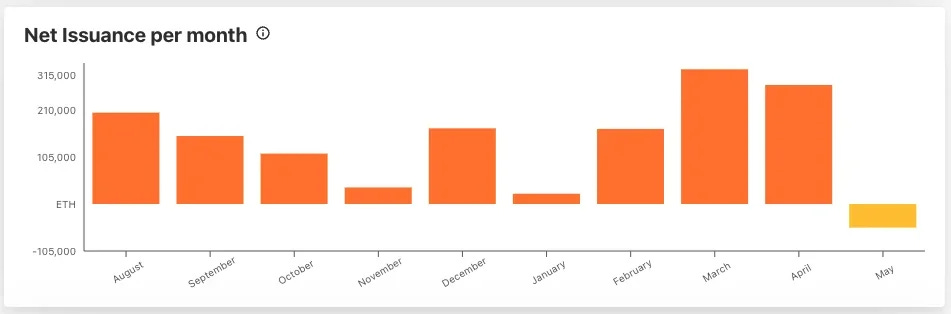

Following the implementation of the London hard fork (EIP-1559 upgrade) in August last year, a base fee of ETH is burned during each transaction. But instead of paying miners for validating transactions, this burning mechanism sends base fees to the defunct wallet to take them out of circulation. This was done to ease the network’s switch from the proof-of-work (PoW) to the proof-of-stake (PoS) consensus model, if and when it happens.

While it was initially meant to take nearly $30 million worth of Ethereum out of circulation each day, due to Otherdeeds skyrocketing demand, the minting process took the blockchain's net issuance (the amount of Ethereum created minus the amount burned) to -52,899 ETH.

What’s more, the NFT sale had ripple effects on the entire blockchain. Simple crypto transfers which would normally cost less than $15 now required several thousand dollars in fees. To add to this, since the purchase was only possible through APE, traders engaged in literal pump and dump, which shot up APE to $26 before immediately plunging 50% once the swap was complete.

All this while BAYC NFT owners got their Otherdeeds without paying anything.

Naturally, traders were not happy. Several users took to Twitter to express their dissatisfaction as disruptions in Ethereum-based services caused them thousands of dollars in gas fees.

Yuga Labs later tweeted, promising to reimburse users for the gas fees associated with failed transactions. But it's still unclear what the refund process will look like.

Recently, Yuga Labs has made great efforts to distance itself from the ApeCoin DAO, which operates as a distinct entity to avoid facing regulatory scrutiny. And while it doesn't control the DAO, it has enormous influence that it can exert on proposals via its voting rights.

The incident also prompted some users to suggest ways to enhance the process in the future, while others saw it as a way for Yuga Labs to acquire consent for its new network.

But we’ve already seen how that works IRL. Axie Infinity, a play-to-earn blockchain-based video game, operates on its dedicated proof-of-stake chain, Ronin. The blockchain recently came under attack, losing around $625 million due to its vulnerability in a special program called the bridge that makes it possible to connect its sidenet to the Ethereum mainnet.

While Yuga Labs mentioned that it’s creating its own chain, a separate ApeCoin blockchain would also restrict the Ape economy to a single network, including Bored Apes, spin-off collections (Mutant Apes, Caked Apes, Bored Ape Kennel Club), and other Yuga-owned properties. But again, its influence over ApeCoin DAO makes it appear more like a centralized system benefitting the venture capital firms backing it.

Share what you learn 🤝

Found this newsletter insightful? Well, then subscribe and share it with your friends and colleagues.

We, at Mesha, believe in democratizing finance. Join us and share your thoughts with our growing community.