Hey👋

Welcome to the mesha tribe: a biweekly newsletter by mesha that brings you all the latest developments in Crypto, NFTs, and Web3 to help you take your net worth #ToTheMoon🚀

📢 We’re inviting 1,000 early access users to team up and buy NFTs with Mesha. Create a team wallet, invite your friends, and split the costs (including gas) across the team.

Benefits:

An original NFT designed by Mesha

100,000,000 $MESHA tokens allocated for early access

Periodic giveaways of blue-chip NFTs to our first 1,000 users

Early access is open to anyone in our community who has reached Level 4, or higher. Get involved in our Discord, share your favourite NFTs, and meet your next teammates!

Sounds good? Sign up below👇

🎙️Spill the NFT: We host a weekly Twitter Space where we invite industry experts to discuss their experiences and latest developments in NFTs and Web3 every Thursday at 8 PM IST. Check out our Twitter page for the guest list 👀

Great! Let’s get to it.

The Big Story

The recent news cycle has been full of:

record interest rate hikes and inflation

massive Ce-DeFi collapses such as Terra and Celsius

crypto hedge funds like 3AC going insolvent, and

historic layoffs by crypto exchanges.

Basically, things are looking pretty shit right now, even more so for crypto.

But if you've been in finance long enough, you know it can find ways to profit off the most bearish markets. And that's what's happening to crypto markets as well.

Starting today, you can buy an exchange-traded fund (ETF) based on shorting Bitcoin.

ETF provider ProShares has announced the launch of ProShares Short Bitcoin Strategy ETF, which will allow investors to profit by betting against the world's largest cryptocurrency. The fund will inversely track Bitcoin's price from the S&P Chicago Mercantile Exchange BTC Futures Index. It will be listed on the New York Stock Exchange under the BITI ticker today.

“BITI affords investors who believe that the price of bitcoin will drop with an opportunity to potentially profit or to hedge their cryptocurrency holdings. BITI enables investors to conveniently obtain short exposure to bitcoin through buying an ETF in a traditional brokerage account,” ProShares CEO Michael L. Sapir said in a press release.

BITI is the first of its kind in the US, but not the world. In April 2021, Canada-based Horizons ETFs Management launched the BetaPro Inverse Bitcoin ETF on the Toronto Stock Exchange.

But if ETFs aren't your thing, ProShares has still got you covered.

The firm's mutual fund affiliate, ProFunds, has also announced that it's launching Short Bitcoin Strategy ProFund (BITIX) tomorrow for investors who prefer mutual funds. BITIX will share the same investment goal as BITI.

But the markets stay sellin'

The launch comes amid a brutal sell-off in the broader crypto markets, with no signs of slowing down. BTC is trading slightly below the key resistance level of $20,000, while Ethereum (ETH) is just under the $1000-mark. The total market cap of digital currencies is at $917 billion, well below its peak of around $3 trillion in November 2021.

While this may seem like bad timing, ProShares isn't new to the volatility game.

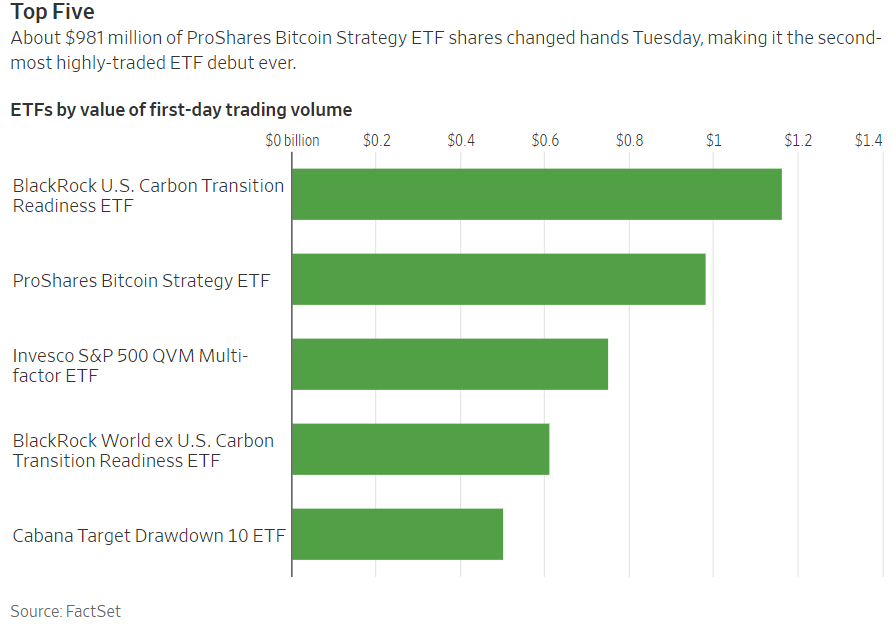

Eight months ago, the firm received approval from the Securities and Exchange Commission (SEC) to establish the first US Bitcoin Futures ETF when BTC rose to more than $63,200. And it was a massive success. On its first day of trading, the ProShares Bitcoin Strategy ETF 'BITO' traded around $1 billion of volume, marking the second-largest ETF release ever.

No spot, futures only

What's interesting about such ETF launches getting the SEC approval is that instead of allowing investors to trade the cryptocurrencies directly, they only allow you to bet on their future price.

A spot Bitcoin ETF would trade on the actual price of the cryptocurrency as opposed to trading on the price of Bitcoin futures. While regulators claim that futures ETFs are less exposed to potential manipulation and custody risks, proponents of spot ETFs have said that this could massively diminish returns for investors due to contango—an issue which has constantly been flagged by investors in other commodities futures ETFs.

So, for years, asset managers and traditional exchanges have tried to create funds that hold actual Bitcoins. But they were rejected by the Commission over fraud and market manipulation concerns.

Currently, more than 4,000 petitions are seeking approval for the Bitcoin spot ETF. Why? Because there’s a huge market for it. A Nasdaq survey of 500 financial advisers found that 72% would be more comfortable investing in crypto if there was also a spot ETF.

So, is there a way out?

In order to list spot ETFs, the SEC mandates crypto exchanges to have comprehensive surveillance-sharing agreements with a regulated market or group of markets of significant size. Although, one can see how this could become a problem.

“I don’t think it’s gonna happen because I don’t see why those big crypto exchanges would want to centralize when the whole industry is made up around a decentralized concept.” Teucrium CEO Sal Gilbertie told CNBC.

Still, crypto firms aren't giving up easily.

Grayscale Investment, a New York-based crypto investment firm, has recently threatened to sue the regulator after the Commission rejected its bid for spot-bitcoin ETF.

Since 2017, the firm has been seeking SEC approval to transform its $20 billion Grayscale Bitcoin Trust into an NYSE-traded ETF that could potentially unlock $8 billion for investors. It has recently hired a top legal mind from the former Obama administration to help with the potential lawsuit if its application gets denied. The SEC has until July 6 to make a final decision.

While most analysts remain bearish on the SEC approval, such a decision would be a significant milestone in the greater adoption of digital assets by non-crypto savvy investors without them having to deal with the associated risks. Still, the hope persists.

Share what you learn 🤝

That’s all for today.

If you found this newsletter insightful, subscribe and share it with your friends and colleagues.

Or sign up and discuss the above stories yourself.

See ya!👋