💃 band baaja baaraat

Gold prices stay rising, Vi is back in the game, Uni raises Series A and more updates.

Hey 👋

Welcome to the mesha tribe. A biweekly newsletter by Mesha that brings you valuable insights from finance, biz, and tech to help you take your net worth #ToTheMoon🚀

Sounds good? Sign up below 👇

Great! let’s get started.

First up,

Market Recap 📈

Indian benchmark indices ended higher after four sessions of continuous losses, led by IT, oil & gas, and consumer durables. Meanwhile, US stocks rose on optimism over Fed's policy tightening to curb inflation.

Sensex: 57,901.14 (+0.20%) ↑

Nifty 50: 17,248.40 (+0.16%) ↑

Dow Jones: 35,927.43 (+1.08%) ↑

Nasdaq 100: 16,289.60 (+2.35%) ↑

Bitcoin: $49,144.05

Top Stories 📰

1. Wedding bells set gold ringing

‘Tis wedding season, and as expected, one metal is once again in demand: Gold.

Following the Indian government's easing of restrictions, around 2.5 million weddings have taken place. Naturally, this has led to an excess demand for gold which industry analysts believe will continue to rise due to lower prices.

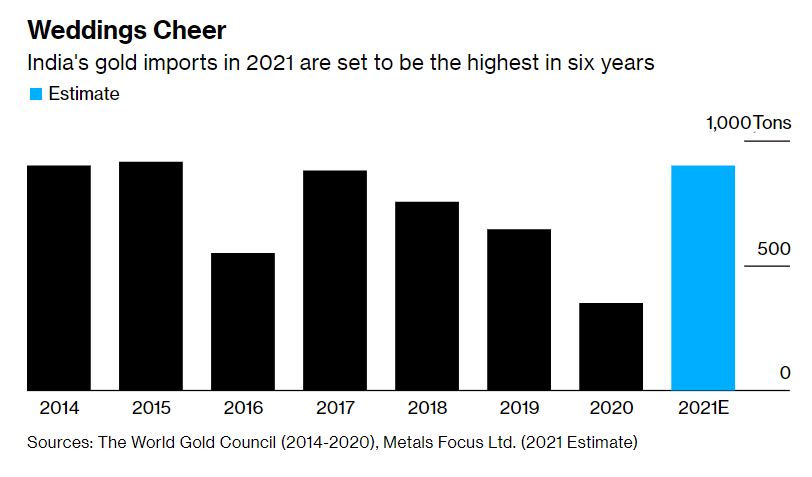

According to Metals Focus Ltd, an independent precious metals research consultancy, India's gold imports are estimated to reach around 900 tons this year—the highest in six years. Another gold governing body, World Gold Council, expects India's gold consumption to be the best in at least a decade...unless there's another COVID-19 wave in the country.

India is the world’s second-biggest gold consumer after China, with purchases usually peaking from October to December. Due to a correction in November, jewellery dealers have been able to purchase gold at lower levels in anticipation of a retreat in prices, citing healthy retail demand for precious metals.

As of writing, gold futures stood at Rs. 48,360 for 10 grams on the Multi-Commodity Exchange (MCX).

Why it matters? Despite the US Federal Reserve introducing a three quarter-percentage-point interest rate hike by the end of 2022, gold prices surged as the move was "largely expected" by the market, which had already discounted the gold prices.

2. Vi boosts its capex for 4G revamp

India’s only loss-making private telco is making a comeback!

Vodafone Idea (Vi) announced that it's boosting its annual capital expenditure (capex) four-fold, from $500 million to $2 billion, to compete against rivals Reliance Jio and Bharti Airtel.

The revelation comes after an internal investors' call this week, where Vi said that it will close the equity funding, which will also infuse promoters' equity, by March 2022.

Since 2019, the cash strapped telco has consistently lost its revenue and market share every quarter to financially strong rivals Jio and Airtel, who invest nearly $3 billion each in annual capex to expand network coverage and capacity.

A quick glance at Q2 results:

Revenue rose 2.8% to Rs 9,406.4 crore

Net loss stood at Rs 7,132.3 crore for the quarter

Operating profit grew 4.2% to Rs 3,862.9 crore

253 million subscribers compared to 255.4 million last quarter

While Vi's recent structural reforms and tariff hikes helped them stay in the three-player market, this capital influx will ensure the telco's ability to successfully speed up its 4G operations across its 17 priority market.

The company also hinted at increasing its tower footprint by 20,000 sites. On Wednesday, Vi's shares dropped 2.28% to close at ₹14.97.

Why it matters? India will likely begin 5G spectrum auctions in April-May. While Jio and Airtel already plan on allocating their capital towards 5G, Kumar Mangalam Birla, chairman of Aditya Birla Group that owns 27.66% of Vi, said that "meaningful 5G investment is still some time away, as there is still no strong use case."

Deal Street 🤑

NFT music startup raises $5 million

Sound.xyz, a startup that helps recording artists crowdfund their work via NFTs, has raised a $5 million seed round. The round was led by Andreessen Horowitz (a16z), with participation from 21 Savage, Weekend Fund, Variant Fund, Scalar Capital, among others. Sound's first product, Listening Parties, allows musicians with low-to-mid-sized followings a limited supply of NFTs linked with their new releases. These NFTs are stored on the Ethereum blockchain and are branded with the artists' names. The startup recently collaborated with several “crypto-friendly” recording artists to release a curated set of NFT drops. Sound, which has eight musicians on board so far, now aims to double down on its listening parties NFT drops and create new incentive models and revenue streams for creators.

Uni raises $70 million in Series A

Bengaluru-based fintech startup Uni has raised a $70 million Series A funding round at a $350 million valuation, led by General Catalyst. The round, which is the second-largest Series A round after CredAvenue's $90 million funding round in September, saw participation from existing investors like Accel India and Lightspeed, and new ventures, including Elevation Capital, Arbor Ventures, and Eight Roads Ventures. Founded last year, Uni offers a 'Pay 1/3rd card' that lets users, usually with existing credit scores, make purchases by splitting the costs of their bills into three parts. It competes with startups like Simpl, Dhani, and Slice, which offer similar repayment systems. The startup has four new products in the pipeline that it will launch next year. The new capital will be used for expanding the user base and boosting its marketing efforts.

Tweet Of The Week ✨

Share what you learn 🤝

Found this newsletter insightful? Well, then forward it to your friends and colleagues. Or share it on your social media.

Feel like discussing the above stories yourself? Join us.

Bye! 👋