Hey guys 👋

Hope you had a great weekend!

Welcome to the mesha tribe—a biweekly newsletter by mesha, an exclusive social community that lets you chat with friends, discover stocks and participate in challenges all on one platform.

Sounds Good? Sign up below 👇

Great. Let’s do this!

The Big Story

If history has taught us anything, it's that patterns emerge in almost every human-made design. And stock markets are no exception.

Back in the 1920s, investing in stocks had become a new fad as the US stock market saw an unprecedented inflow of investments where people bought stocks in instalments, on margins, through investment clubs, and even using capital instead of their income.

Fast forward 100 years later, a new trend in the stock market has emerged known as Environmental, Social, and Governance (ESG) investing.

Also known as impact investing or sustainable investing, it's a set of criteria that potential investors focus on while making their investment decisions.

There are three parts to this strategy -

Environmental: how a company performs as a steward of nature.

Social: how it manages its relationship with suppliers, producers, employees, and consumers.

Governance: focuses on a company's leadership, executive decisions, internal control, and other things.

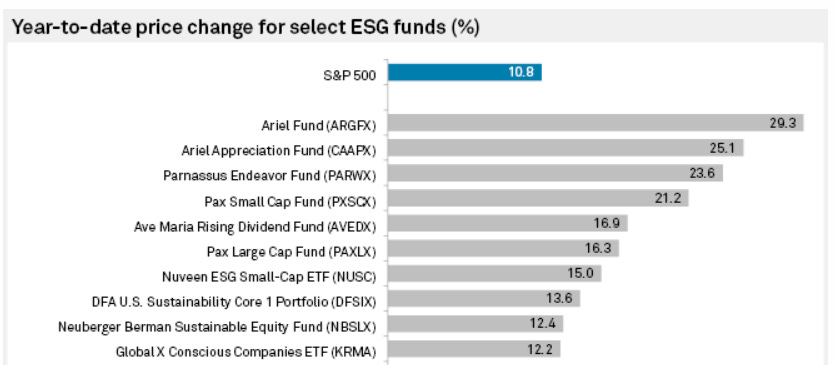

Given the volatility that we're seeing today—climate change, protests and the COVID-19 pandemic—, ESG investing has started to gain mainstream momentum. At the start of 2020, when the pandemic first shocked global markets, investments in sustainable funds saw a net inflow of $45.7 billion. What’s more, around 75% of ESG funds also outperformed the benchmark S&P 500 index, highlighting the growing demand for such investments.

Recently, the trend has also attracted some attention in India. While ESG investing is still in a nascent stage, favourable demographics and active regulatory support may boost the industry in the coming years and shift focus from being a risk-mitigating tool to a core strategic priority. So far, India has about 10 ESG-focused funds.

But just like any other investment strategy, ESG investing isn't safe from criticisms. Often when people discuss sustainable funds, its selection methods are highly debated. These opinions are warranted given the inherently subjective nature of these qualitative metrics, which begs the question: is it just a bull market fad? Social Capital CEO Chamath Palihapitiya thinks so. “These are useful statements. It’s great marketing. But again it’s a lot of sizzle, no steak,” he told CNBC.

Additionally, a recent study showed that investors are ‘winging it’ when making ESG investments by relying on brand recognition and personal judgements and don't use available research and metrics by ESG-rating providers.

The result? Tesla took the top spot as 30% of investors identified the electric carmaker to be closely aligned with ESG values, even though ESG screeners like MSCI rated Tesla as "High Risk" due to its governance and labour issues. The study also highlighted that more than 68% of investors cited finance and business websites, while only 37% claimed to have used ESG funds and stock screeners for evaluating whether their investment met ESG standards.

That said, the future is still bright for ESG funds as analysts expect them to become a standard option for investing as firms continuously strive to offer greater transparency on their sustainable characteristics in the future. As of now, sustainable investing accounts for more than a third and is expected to reach $53 trillion by 2025. For India, while the industry is in its early stages, there are some ESG mutual funds that you can start investing in today.

Share what you learn 🤝

Well, that's all for today. If you found this newsletter insightful, share it with your friends and colleagues and let us know what you think in the comments.

Join us and be a part of a community that helps you to take your net worth #ToTheMoon🚀 (Tip: We’re currently running a 10K Investor Challenge where you can win INR 10,000)

See ya later, Bye! 👋