Hey 👋

Happy New Year 🎆 Great to see you in 2022.

Welcome to the mesha tribe—a biweekly newsletter by Mesha, an exclusive social community that lets you chat with friends, discover stocks and participate in challenges all on one platform.

Sounds good? Sign up below 👇

Awesome. Let’s go!

The Big Story

2018 - $1 trillion

2020 - $2 trillion

2022 - $3 trillion

The new year has just started, and Apple has already achieved another incredible feat. The California-based tech giant has now become the first American company—and also the first publicly traded entity—to reach $3 trillion in market capitalization.

To put that into perspective, it's now worth more than Netflix, Disney, Nike, McDonald’s, Exxon Mobil, Morgan Stanley, Walmart, Coca-Cola, Ford, Comcast, AT&T, Boeing, Goldman Sachs, and IBM combined!

And if that wasn't enough comparison, Apple now accounts for 3.3% of all global stock markets' value and makes up for nearly 7% of the total value of the S&P 500, crushing IBM's previous record of 6.4% in 1984.

So how did it do it all?

Well, the latest rally helped the tech giant's stock prices to ascend to $182.88 on Monday, subsequently closing its first trading of the year 2.5% higher at 182.01 and bringing its market value to around $2.99 trillion. The advancement is also due to the overall positive outlook for the stock market despite Omicron concerns, with Apple and Amazon contributing to the Nasdaq 100 Index outperforming.

While Apple only briefly touched this milestone, it's symbolic enough to keep investors bullish on its stock and showcase its ability to grow and provide value.

The pandemic-era growth

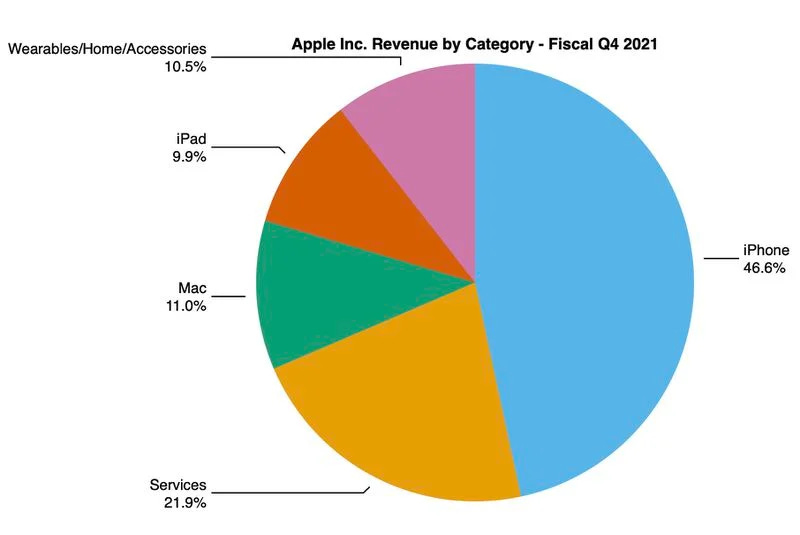

For years, Apple has been considered as the safest tech stock mostly because of its outstanding balance sheet and strong cash flow, which it uses for stock buybacks, dividends, and investing in VR headsets and autonomous EVs. Investors remain interested in the stock due to the fact that since 1990, Apple has returned 22,000%, or around 28% a year. And given that quarter of its sales comes from its services business—2X as profitable as hardware products like iPhones and Macbook—analysts expect its cash flow to be at least $100 billion every year over the next decade.

But since the onset of the COVID-19 pandemic in March 2020, when its competitors were struggling to keep up, Apple managed to attain more than 200% growth by aggressively focusing on consolidating entertainment, work, and education. And it certainly paid off, I mean, just look at its Q4 earnings report -

Revenue up 29% YoY to $83.4 billion.

Services business grew 25.6% YoY, bringing around $18 billion during the quarter.

Wearables climbed 20% YoY growth, led by new AirPods sales.

But it was particularly the excitement surrounding the launch of new products—one of its biggest criticism the company received over the last five years—that helped Apple wither the pandemic-related disruptions which even led its peers, including Google, Meta, and Amazon, to close down last month while it remained up 3.1%.

Some other setbacks

While it might seem like now’s the right time to jump in on the opportunity, there are some issues that the company is still trying to navigate through. Two that stand out are regulatory scrutiny over in-app practices and premium stock prices.

Recently, Apple has been facing regulatory scrutiny over its App store practices and dealings with third-party app developers in the US and India. The company has received complaints from antitrust authorities, claiming that the 30% fees it charges global to developers hurt software makers and competition.

In addition, investors remain wary about Apple's ability to expand its user base and squeeze cash from each of them, considering there's no guarantee over the successes of its new products. While its stock is currently trading at a premium of 4.5% compared to its average historical multiple, analysts alleviate some investor doubts as they believe that it's 'deservedly' doing so...as long as its iPhone cycle remains intact. They remain even more bullish following Apple's decision to venture into the EV business, citing the huge market potential.

Share what you learn 🤝

That’s all for today.

If you enjoyed reading this edition, share it with your friends or colleagues and let us know what you think!

We at Mesha believe in democratizing finance. Join us and be a part of a community that helps you to take your net worth #ToTheMoon🚀

Until next time 👋