📈 2000% growth

Blockchain games are killing it, Beanstalk loses $182M in "flash loan" attack, Framework Ventures raises $400M, and more.

Hey👋

Welcome to the mesha tribe: a biweekly newsletter by mesha that brings you all the latest developments in Crypto, NFTs, and Web3 to help you take your net worth #ToTheMoon🚀

📢 We’re inviting 1,000 early access users to team up and buy NFTs with Mesha. Create a team wallet, invite your friends, and split the costs (including gas) across the team.

Benefits:

An original NFT designed by Mesha

100,000,000 $MESHA tokens allocated for early access

Periodic giveaways of blue-chip NFTs to our first 1,000 users

Early access is open to anyone in our community who has reached Level 4, or higher. Get involved in our Discord, share your favourite NFTs, and meet your next teammates!

Sounds good? Sign up below👇

Great! Let’s get started.

Crypto Market Update 📈

The global cryptocurrency market cap rose to the $1.95 trillion mark, rising 0.51% over the last 24 hours. The total crypto market volume grew 9.81% to $96.93 billion during the same period.

Bitcoin (BTC): $42,358.56 (+1.32%)

Ethereum (ETH): $3,137.67 (+0.52%)

Tether (USDT) : $1 (-0.03%)

Binance Coin (BNB): $424.61 (-0.57%)

Top Stories 📰

1. Blockchain games FTW

While the crypto market recoils amid ongoing geopolitical tensions and supply chain woes, blockchain games are leading the decentralized application (dapp) industry.

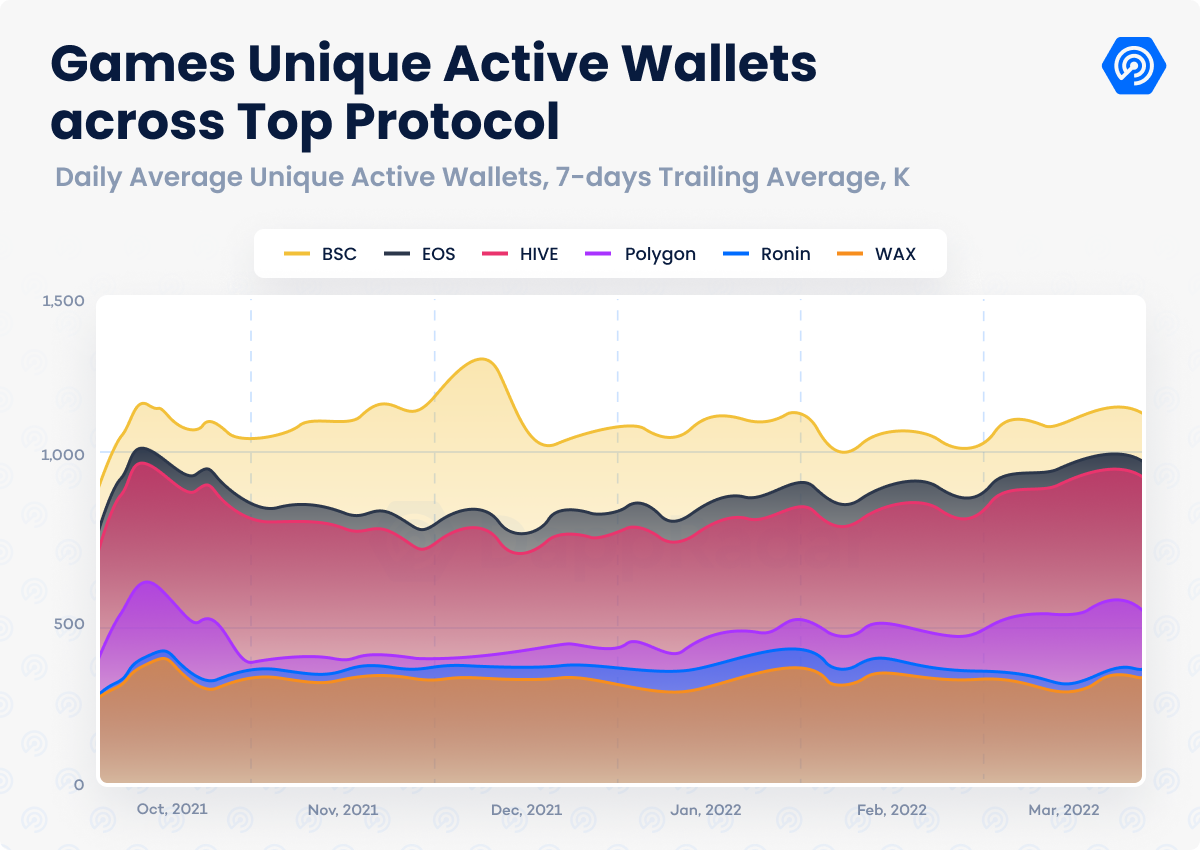

According to a new DappRadar report, since last March, blockchain-powered games have attracted 1.22 million daily unique active wallets, accounting for 52% of the entire blockchain industry's activity. As a result, the blockchain gaming activity has grown a staggering 2000% during the same period.

What else?

VC investments surpassed $2.5 billion in Q1 2022, with developers expecting this figure to grow to $10 billion by December.

NFTs generated $12 billion in trading volume, with increased sales on blockchains other than Ethereum: Polygon (+34%), Avalanche (+582%), and Solana (+34%).

Interest in the metaverse contracted as trades dropped 12% to $430 million in the first quarter, with average land prices in Decentraland and The Sandbox falling to 40%.

Except for the last point, which was mainly hyped following Facebook’s rebranding and metaverse announcement, dapps’ progress so far has been pretty impressive.

But a flurry of hacks and bridge exploits has led the industry to incur $1.2 billion in losses and has brought DeFi's security concerns back into the mainstream discussion.

Why it matters? Today, the total value locked in DeFi protocols and GameFi is $214 billion and $28 billion. While it's not much compared to crypto's $1.9 trillion market cap, the industry continues to generate massive interest from users and investors alike. And as more VCs, financial institutions, and sports brands continue to invest in the space, its mainstream adoption is imminent.

2. Beanstalk loses $182M in governance exploit

3 years, 86 attacks. Things just aren't going so well for DeFi protocols.

On Sunday, a hacker managed to drain around $182 million worth of crypto from Beanstalk Farms, an Ethereum-based stablecoin protocol. The attack was flagged by blockchain analytics firm PeckShield and was later confirmed by Beanstalk.

Wait, but how did it happen? To understand this, let's first learn more about Beanstalk.

Basically, it's a decentralized credit-based stablecoin protocol where participants earn rewards by contributing funds to a central funding pool (the silo) used to balance the value of one token (bean) at close to $1.

In this case, the attacker took out a series of flash loans—a type of unsecured financing that lets users borrow large amounts of money for a very short time period (think mins or seconds)—worth $1 billion on its lending platform Aave, and used it to amass its native governance token, stalk.

The attacker then traded them for enough beans to acquire over 67% majority voting stake, thus allowing the attacker to transfer all assets in the Beanstalk contract to a personal wallet. Shortly after, the attacker repaid the flash loan and netted $80 million in profits (excluding funds required to perform the attack).

All this happened in only 13 seconds.

Later, Peckshield said that the attacker laundered all funds through Tornado Cash—a mixer that allows users to hide their digital trail—and donated around $250,000 to a Ukrainian relief wallet.

While it appears that the victims of the attack have little to no recourse, Beanstalk said that they're planning to host “some sort of fundraise.” As of writing, the bean token is trading at $0.067.

Why it matters? Many commentators have said that the beanstalk hack wasn't actually a hack. It was a corporate raid reinforced by undefined regulation of ownership or voting control.

Deal Street 🤑

CoinDCX raises $135M

Indian crypto exchange CoinDCX has raised a $135 million Series D funding round at a $2.15 billion valuation, a week after suspending rupee deposits amid regulatory scrutiny. Led by Steadview Capital and Pantera Capital, the round included participation from existing investors like Coinbase, Polychain, Cadenza, and new investors, including Republic, Kingsway, Kindred, and DraperDragon. The latest fundraise doubles the Mumbai-based startup's previous valuation of $1.1 billion. Founded in 2018, CoinDCX allows people to trade crypto tokens and offers crypto-enabled financial services like lending. While the company has over 12 million registered users, its trading volume reached a six-month low after India announced a 30% tax on crypto incomes. The latest capital injection will be used for hiring staff, crypto education, and building an innovation centre for Web3 products.

VC firm raises $400M Web3 fund

Framework Ventures, a San Francisco-based crypto VC investment firm, has raised $400 million for its third crypto-focused fund. Half of the money from the fund, known as "FVIII," will be invested in Web3 and DeFi projects, while the other half will be allocated for blockchain gaming space. The announcement brings the company's total assets under management to $1.4 billion, making it one of the biggest venture investment funds in the blockchain industry. In 2019, Framework was one of the first few firms to bet on the DeFi space when it was worth only $1 billion, investing in several DeFi projects like The Graph, Chainlink, Tokemak, and Aave. Today, Framework feels the same way about blockchain gaming due to massive growth and innovation in Layer 2 and non-Ethereum blockchains. It has already invested in gaming infra project Stardust and play-to-earn game developer Illuvium.

Tweet Of The Week ✨

Share what you learn 🤝

Found this newsletter insightful? Well, then subscribe and share it with your friends and colleagues.

Sign up and discuss the above stories yourself.

See ya next week!👋